Advisor Perspective

Read this month’s featured articles:

Highlights of Heckerling 2026: Charitable Estate Planning

The 60th annual Heckerling Institute brought together thousands of estate planning professionals for a fast-paced week focused on new tax laws, trust planning, inherited IRA accounts, and so much more. Here are the Professional Advisor Network’s top five takeaways advisors should know coming out of this landmark event.

Read the article: Highlights of Heckerling 2026...

Estate Planning After OBBBA 2025: What Now?

Estate Planning After OBBBA 2025: What Now?

The One Big Beautiful Bill Act of 2025 has reshaped estate planning, permanently raising the federal estate tax exemption and shifting the focus away from federal estate taxes for most families. Today’s planning priorities center on income tax efficiency, state estate taxes, and ensuring documents still work as intended under the new law. Learn why now is the right time to revisit estate plans—and how smart updates can unlock new tax and charitable planning opportunities.

Previous articles:

Opening the Door to Generosity: How Advisors Can Help Clients Leave a Lasting Legacy

As advisors, we have a unique vantage point. We see the entire scope of a client’s financial picture, which often reveals more capacity for giving than they realize. Starting this conversation builds trust, deepens client relationships, and helps align their finances with their values in a tangible way. It also differentiates us as advisors who see the whole person, not just the portfolio. Learn ways to start the conversation.

Read the article: Opening the Door to Generosity...

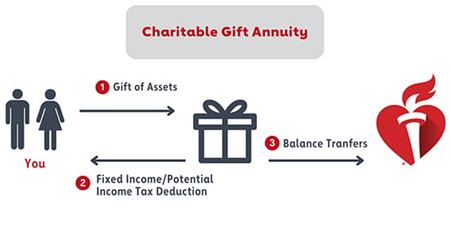

10 Charitable Gift Annuity Questions Advisors Ask

Curious about how charitable gift annuities work and how they compare to other planned giving tools? If you’ve ever fielded client questions or wondered about funding rules, payout rates, or tax treatment, this quick guide breaks down the essentials every advisor should know.

Read the article: 10 Charitable Gift Annuity Questions Advisors Ask

Charitable Planning Under OBBBA: Key Considerations for Advisors and Donors in 2025

Tax changes are coming, and this year-end may be an optimal time for some of your clients to maximize certain charitable strategies before new laws take effect in the new year. This month’s article breaks down what the One Big Beautiful Bill Act means for client planning.

Read the article: Charitable Planning Under OBBBA...

Making Philanthropy a Part of Your Advisory Practice

Many advisors hesitate to initiate conversations about charitable giving, citing concerns such as not knowing enough, potentially losing assets under management, or assuming clients aren’t interested. Yet the evidence suggests otherwise.

Read the article: Making Philanthropy a Part of Your Advisory Practice

The Hidden Hurdles of Using a General Durable Power of Attorney

A General Durable Power of Attorney (GDPOA) is designed to provide continuity and ease the burden of decision-making during a difficult time. Unfortunately, the practical use is often anything but seamless. This article explores the hurdles that GDPOA’s can present so that you can work proactively with your clients to navigate the system.

Read the article: The Hidden Hurdles...

Maximizing Profits: Strategies for a Tax-Efficient Sale of Business Interests, Real Estate, and Other Highly Appreciated Assets

The tax burden of selling highly appreciated assets can be overwhelming. However, there are numerous tax-advantaged strategies available for selling assets like closely held businesses and real estate. The best outcomes often arise when clients plan ahead.

Read the article: Maximizing Profits...

AI and Its Influence on Charitable Planning

We are living in a transformative era of technology. It has been three years since the discovery of generative AI, a breakthrough reshaping the industry at a pace comparable to the rise of the internet in the 1990s. When the web became widely accessible in 1993, businesses began adopting email and websites en masse by 1996, forever changing how we operated. AI is poised to redefine how advisors, nonprofits, and donors interact and plan for the future.

Read the article: AI and Its Influence on Charitable Planning